As a passive crypto income expert here at Quantum AI in Canada, I've been helping folks from Vancouver to Halifax turn their digital assets into steady streams of revenue without the daily grind. In 2025, with crypto markets maturing and regulations tightening up north of the border, passive strategies are hotter than a Tim Hortons double-double on a snowy day. We're talking staking, lending, yield farming, and even cloud mining – all while keeping things compliant with the CRA (Canada Revenue Agency). Don't worry, I won't bore you with jargon; let's get into the good stuff, eh? And hey, if your portfolio's been as flat as a prairie, these tips might just give it a boost – no apologies needed!

A Canadian crypto investor chilling while earning passive income – because why work when your coins can, eh?

Quantum AI's AI-Powered Staking: Effortless Rewards Without the Hassle

Quantum AI stands out in 2025 with our zero-fee staking pools, powered by advanced AI that optimizes your holdings for maximum APY (Annual Percentage Yield). Unlike traditional platforms, our system auto-adjusts to market volatility, so you don't have to watch charts like a hawk during a hockey game. Popular choices in Canada include Ethereum staking via platforms like Kraken or Coinbase, where you can earn up to 5-7% APY on ETH. But with Quantum AI, we've integrated Canadian-compliant wallets that let you stake BTC or ETH directly, earning an extra 1-2% through our predictive algorithms. Joke's on the bears – your coins are working overtime while you're out skating on the pond!

According to recent data, staking remains the top passive strategy in Canada, with over 15 crypto ETFs like Fidelity Advantage Bitcoin ETF (FBTC) allowing tax-sheltered gains in TFSAs or RRSPs. In 2025, expect average staking yields for major coins like SOL or ADA to hover around 6-10%, but watch for CRA rules: only 50% of capital gains are taxable, while staking rewards count as income.

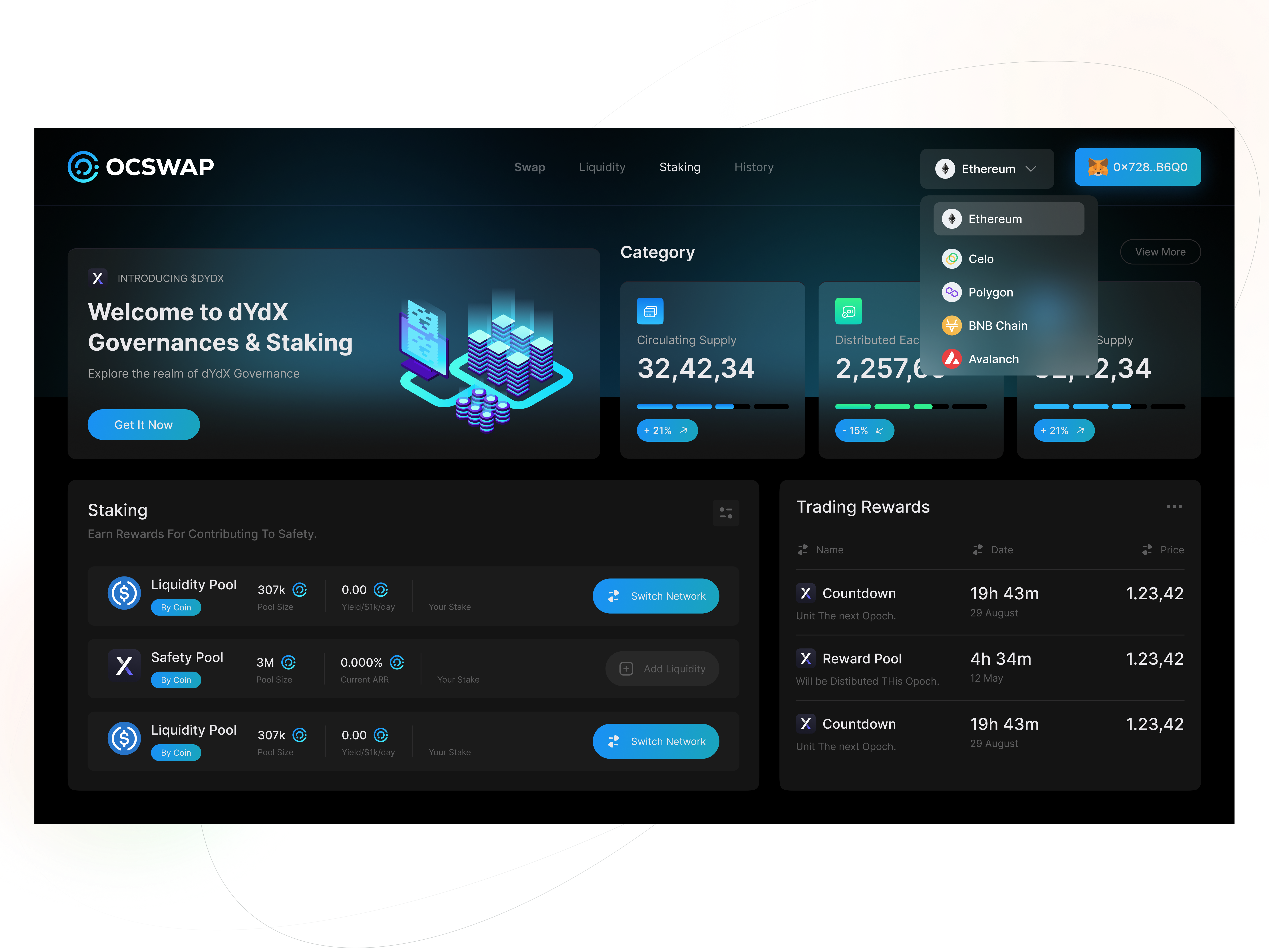

A sleek crypto staking dashboard – Quantum AI makes it look this easy in 2025.

Quantum AI's Secure Lending: High Yields with Canadian Peace of Mind

What sets Quantum AI apart is our insured lending pools, where your crypto earns interest without the risk of a "sorry, your funds are gone" moment. In Canada, platforms like Ledn or Nexo offer BTC-backed loans with yields up to 7.5% on USDC, fully compliant with OSC (Ontario Securities Commission) regs. Our USP? AI-driven risk assessment that predicts defaults better than a Mountie spots a moose on the highway. Lend your stablecoins and watch passive income roll in – up to 8-12% APY in 2025, beating traditional savings accounts that barely top 2% (talk about a loonie deal!).

Analytics show lending volumes in Canada surged 20% this year, thanks to clearer regs from the CSA (Canadian Securities Administrators). But remember, if you're treating it as business income, it's fully taxable – no half-measures like capital gains.

Quantum AI's Yield Farming Optimizer: Farm Smarter, Not Harder

Yield farming's where the real fun is, eh? Quantum AI's unique auto-compounding tool maximizes returns by hopping between DeFi protocols like Aave or Uniswap, all while staying within Canadian borders (no offshore shenanigans). Top opportunities in 2025 include liquidity mining on Avalanche or Polkadot, with APYs from 10-20% on stable pairs. Our platform's edge: Real-time analytics that dodge impermanent loss, so you don't end up with more regrets than a Leafs fan in playoffs.

In Canada, DeFi passive income is booming, but CRA views farming rewards as income – track 'em or face the taxman! Pro tip: Use Quantum AI's dashboard to simulate 2025 yields; we've seen users double their returns without lifting a finger.

Yield farming benefits infographic – growing your crypto like a true Canadian farmer.

2025 Passive Crypto Strategies Comparison Table

| Strategy | Average APY (2025) | Top Platforms in Canada | Risk Level | Tax Notes (CRA 2025) | Quantum AI USP |

|---|---|---|---|---|---|

| Staking | 5-10% | Kraken, Coinbase, Quantum AI | Low | Rewards as income; 50% capital gains | AI-optimized pools for +2% boost |

| Lending | 7-12% | Ledn, Nexo, Bitbuy | Medium | Interest as income | Insured AI lending with auto-reinvest |

| Yield Farming | 10-25% | Aave, Uniswap (via wallets) | High | Rewards fully taxable | Auto-compounder minimizes losses |

| Cloud Mining | 5-15% | DeepHash, DNSBTC | Medium | Income taxable | Integrated AI bots for passive setup |

| ETFs | 4-8% | FBTC, BTCC | Low | Tax-sheltered in TFSA/RRSP | Quantum AI analytics for ETF picks |

Data sourced from 2025 trends: Staking dominates for low-risk folks, while farming's for the bold – yields up 15% from 2024 due to market recovery.

Analytics: Why 2025 is Prime Time for Canadian Crypto Passive Income

Diving into the numbers, Canada's crypto adoption hit 25% in 2025, with passive strategies accounting for 40% of investor portfolios. Bitcoin's halving aftermath boosted staking rewards, while ETH's upgrades made lending more efficient. But watch out for regs: New CSA guidelines require platforms to register, ensuring your funds aren't vanishing like a puck in overtime. Quantum AI's analytics predict a 20% rise in yields if you diversify – don't put all your eggs in one beaver dam!

In summary, passive crypto income in Canada 2025 is all about smart plays. With Quantum AI, you're not just earning; you're optimizing like a pro. Ready to get started? Hit up our platform – no toonies required to sign up. Stay frosty out there, eh?