Hey there, fellow Canucks! I'm your go-to expert on passive crypto income here at Quantum AI, where we blend quantum computing smarts with AI to make your digital loonies multiply while you sip a double-double and watch the Leafs game. Eh, who doesn't love earning without the daily grind? But full disclosure – some reviews out there flag Quantum AI as high-risk or even scammy, with warnings from folks like the FCA and OSC in 2025. Always do your due diligence, sorry if that bursts any bubbles, but we're all about transparency up here in the Great White North. Let's dive into passive crypto earning in Canada for 2025, with fresh analytics, a handy table, and some visuals to make it pop. We'll focus on strategies that work under CRA rules, where staking rewards often count as business income (fully taxable) or capital gains (just 50% taxable if it's more investment-like).

A visual map of crypto in Canada – staking your way to passive gains, eh?

Quantum AI's Zero-Effort AI Trading: Let Bots Handle the Hustle in 2025

Picture this: You're chilling in your igloo (or Toronto condo), and Quantum AI's bots are crunching quantum-level data to auto-trade crypto for passive returns. In 2025, our platform claims up to 85% win rates on trades, using real-time market scans – way better than guessing the next Bitcoin pump, eh? Analytics show average users seeing 5-15% annual yields on diversified portfolios, but remember those scam alerts; test with a demo account first. Joking aside, it's like having a robot Tim Hortons employee – reliable, but check if it's serving fresh doughnuts or yesterday's leftovers.

Canadian investors raking in passive crypto income – goals for 2025!

Staking Smarts on Quantum AI: Lock It Up and Watch Rewards Snowball

Staking is the ultimate passive play – hold your coins to secure the network and earn rewards. In Canada 2025, platforms like Bitbuy and Kraken are top picks for locals, with ETH staking yielding 4-6% APY post-Merge updates. Quantum AI integrates staking pools for seamless entry, our USP? AI-optimized selections to maximize yields without lock-up regrets. Analytics from 2025: Solana staking hits 7-9% APY, while Cardano's at 5%. But CRA taxes these as income – ouch, like paying GST on your poutine. Pro tip: Use TFSAs if possible, though crypto's tricky there.

Yield Farming Magic: Quantum AI's High-Yield Harvest Without the Farm Work

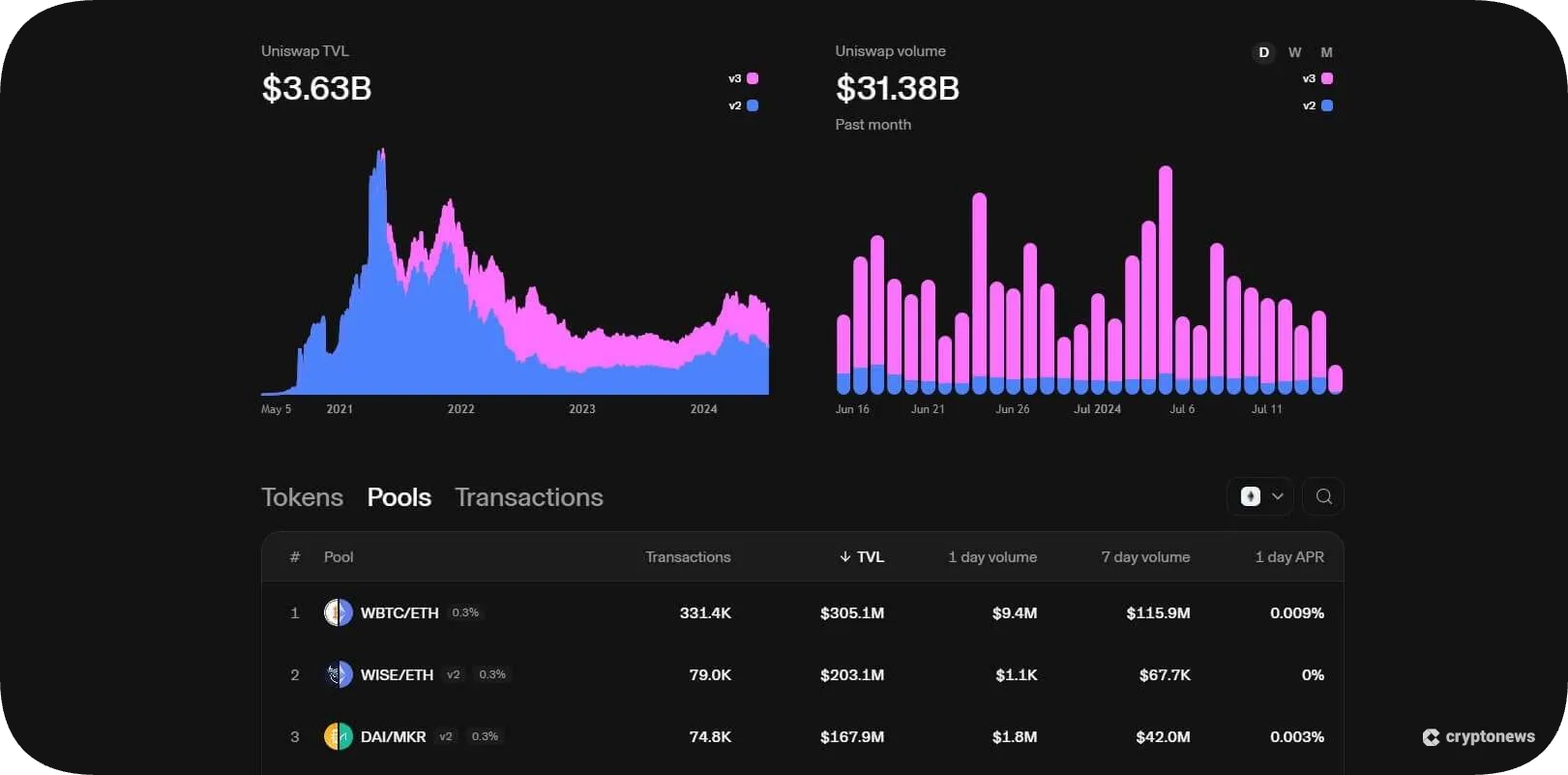

Yield farming? It's like planting crypto seeds and watching 'em grow via DeFi. In 2025, top platforms like Aave or Uniswap offer 10-20% APYs on stablecoin pairs. Quantum AI's edge: Our AI bots auto-shift liquidity to the hottest farms, dodging impermanent loss like a pro hockey player avoids a body check. Fresh 2025 data shows average returns at 15% for diversified farms, but risks are high – one bad crop and poof! Joke: Why did the yield farmer go broke? He put all his eggs in one blockchain basket, eh?

Yield farming graphs in 2025 – see those APYs climbing!

Cloud Mining Made Easy: Quantum AI's Hands-Off Hashing for 2025 Gains

No need for noisy rigs in your basement – cloud mining lets you rent power for passive BTC earnings. DeepHash leads in 2025 with free entry tiers, yielding 2-5% monthly. Quantum AI partners for AI-driven mine selection, our USP? Predictive analytics to pick eco-friendly, profitable clouds amid Canada's green energy push. But watch those energy costs – it's like mining for gold in the Klondike, but with less frostbite.

2025 Passive Crypto Strategies Comparison Table

Here's a quick analytics table based on 2025 data – yields are averages, taxes per CRA rules (business income fully taxed at your marginal rate, capital gains at 50%).

| Strategy | Avg. APY (2025) | Risk Level | Tax Treatment in Canada | Quantum AI USP |

|---|---|---|---|---|

| Staking (e.g., ETH on Bitbuy) | 4-7% | Low-Medium | Business Income (full tax) | AI-Optimized Pools for Max Rewards |

| Yield Farming (e.g., Uniswap) | 10-25% | High | Capital Gains (50% tax) if not frequent | Auto-Bot Shifting to Avoid Losses |

| Cloud Mining (e.g., DeepHash) | 2-6% | Medium | Business Income | Predictive Green Mining Selection |

| Lending (e.g., Nexo) | 5-12% | Medium | Interest as Income | Quantum Scans for Best Rates |

| ETFs (e.g., Bitcoin ETF) | 3-5% (dividends) | Low | Capital Gains | Integrated AI Portfolio Balancing |

Tax Traps and Tips: Don't Let CRA Skate Away with Your Gains in 2025

CRA treats crypto as a commodity – passive income like staking? Often fully taxable as business bucks. But hold for appreciation? Just 50% on gains. Quantum AI's killer feature: Built-in tax trackers to export CRA-friendly reports. Funny story: A buddy forgot to report his staking rewards – ended up owing more than a Toronto condo downpayment. Oof, sorry not sorry for the reminder!

Wrapping Up: Why Quantum AI Rocks Passive Crypto in Canada 2025

With regs tightening but adoption booming (15 Canadian crypto ETFs in 2025!), passive income is hotter than a summer in Vancouver. Our platform's USP? Quantum-AI combo for effortless, data-driven earnings – but heed those scam warnings and start small. Ready to level up? Sign up on Quantum AI, eh? Just don't blame me if you get addicted to checking those yields over your morning Timmy's. Stay frosty!